- Just Followed Digest

- Posts

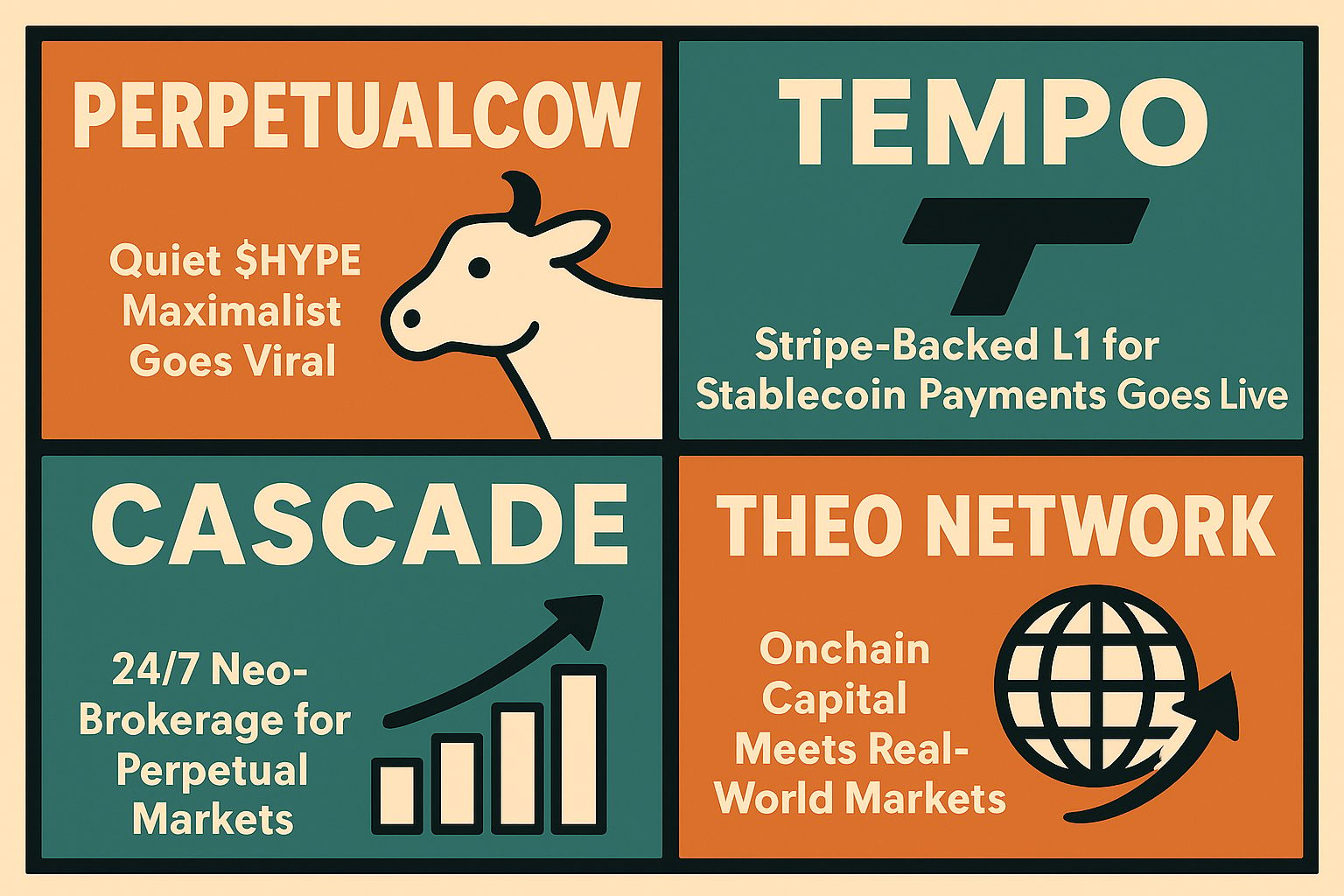

- Onchain Markets, Stablecoin Rails, 24/7 Perps, and Real-World Assets

Onchain Markets, Stablecoin Rails, 24/7 Perps, and Real-World Assets

Issue #98 of the Just Followed Digest

Hey there! 👋

Welcome to a new issue of Just Followed Digest - your go-to source for trending projects and standout accounts in the crypto space.

In today’s issue, we’ve got $HYPE maximalists, a Stripe-backed L1, a perpetual markets exchange, and a network that connects on-chain capital to traditional markets. So without further ado, let’s dive in. 🚀

Top Trending Today*👀

PerpetualCow: Quiet $HYPE Maximalist Goes Viral

Tempo: Stripe-Backed L1 for Stablecoin Payments Goes Live

Cascade: 24/7 Neo-Brokerage for Perpetual Markets

Theo Network: Onchain Capital Meets Real-World Markets

*this is a curated list of accounts and projects, and it may differ from the list of top accounts on leak.me |

TOP Trending, December 10, 2025

PerpetualCow: Quiet $HYPE Maximalist Goes Viral

PerpetualCow is a pseudonymous Crypto Twitter account dedicated to Hyperliquid (HL), the top decentralized perps exchange. The tone appeals to serious perps traders who value quant insight and steady conviction.

The account exploded in visibility on December 9–10 after posting “Infrastructure Capture Dynamics in Decentralized Derivatives Markets,” a long-form thread arguing that $HYPE could reach $2,000. The argument ties the “Great Wealth Transfer” ($84T shifting from TradFi to crypto) to exponential perp growth.

The case highlights Hyperliquid’s edge: sub-second settlement, 24/7 access with no geographic barriers, and programmatic fee burns that compound value. The clean math and sober framing hit a nerve. The thread quickly spread across trader circles, earned praise from KOLs, and turned PerpetualCow into a reference account for patient $HYPE believers during HL’s ongoing momentum.

Tempo: Stripe-Backed L1 for Stablecoin Payments Goes Live

Tempo is a Layer-1 blockchain purpose-built for high-speed, low-cost stablecoin payments. Incubated by Stripe and Paradigm, the project launched in early 2025 with more than $500M in funding from Greenoaks, Thrive, and other top-tier investors. The bio says it all: “The blockchain designed for payments.”

Tempo is trending after its public testnet launch on December 9, which opened access to developers and showcased integrations with Kalshi, Mastercard, and UBS. The launch lands at the perfect moment: demand for efficient stablecoin rails is exploding post-regulatory clarity, and Tempo’s near-zero fees and no-congestion architecture make it feel like a direct upgrade to legacy payment rails.

In a market searching for real utility, Tempo’s pitch—global transfers at one-tenth of a cent—has become a viral talking point for Web3 remittances, enterprise adoption, and the future of stablecoin settlements.

Cascade: 24/7 Neo-Brokerage for Perpetual Markets

Cascade is a New York–based crypto project that launched in December 2025 as the first “autonomous neo-brokerage” specializing in 24/7 perpetual markets. Users can trade perps across crypto, U.S. equities, commodities, forex, and even synthetic exposure to private assets like SpaceX or OpenAI — all from one unified margin account. The platform supports USD bank transfers and stablecoin on-ramps, aiming to combine deep liquidity, fast execution, and U.S. compliance in a single product.

Backed by Polychain Capital, Variant, Coinbase Ventures, and Archetype, Cascade raised $15M in seed funding, announced on December 9. This milestone is driving the current trend: a compliant, around-the-clock alternative at a moment when interest in U.S. perpetuals is soaring. Coverage from CoinDesk and other outlets helped amplify early buzz, while influencers and VC trackers are spotlighting the launch as a bridge between TradFi and DeFi. With early access now open to select users, Cascade is gaining momentum as traders look for a domestic, always-on platform that doesn’t force them offshore.

Theo Network: Onchain Capital Meets Real-World Markets

Theo Network connects onchain capital to traditional markets through tokenized Treasuries. Its main product, thBILL, is an ERC-4626 money market fund backed by institutional custodians and rated AAA. Founded by ex-Optiver and IMC traders, Theo raised $20M from Hack VC, Anthos, and others.

The platform spans Ethereum, Arbitrum, Base, StableChain, and integrates with Morpho, Pendle, Euler, Stargate for minting, bridging, and delta-neutral strategies. Partnerships include Standard Chartered’s Libeara and Wellington.

Theo is trending due to fast TVL growth — from $129M to $215M in two months — boosted by a $75M thBILL deposit, LayerZero interoperability, and a Kaito points campaign ahead of a potential TGE. Analysts call it a “liquidity layer for RWAs”, driving attention across crypto Twitter.

Other trending accounts

Thedealsguy: great retail deals & drops.

Kenan Saleh: Investment Partner a16z.

DeepNode AI: The foundation for open, honest AI.

Space: The first leveraged prediction market on Solana.

Reply